What Is An Elevation Certificate for Flood Insurance

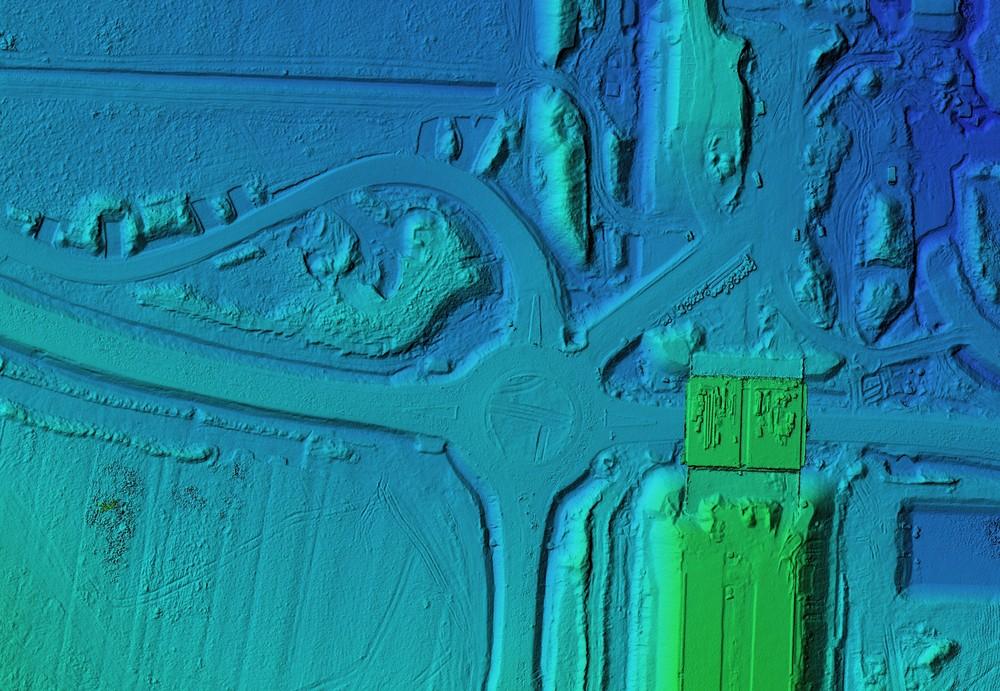

If you are purchasing property or live in an area that is deemed to be a high-risk flood zone, you will typically be required to buy flood insurance from the National Flood Insurance Program (NFIP). To purchase flood insurance, you will need to obtain an elevation certificate by a residential surveyor, which is necessary to document specific characteristics of the property, such as location, flood zone, an elevation floor at the lowest point. These characteristics help insurance agents to determine the overall risk of damage to the property that may be present in the event of a flood and designate the appropriate premiums for the insurance.

An elevation certificate is used for determining just how vulnerable your property is, should a flood occur. It provides insurance companies with the information they need to calculate any flood insurance premiums.

How Can An Elevation Certificate Save Money?

If you provide your insurance company with an updated elevation certificate for your property, you may be able to save money on your premiums. FEMA performs studies yearly to assess flood hazard information. However, there are limitations to how many areas they can re-assess during the year. Studies may indicate that a flood plain has changed. When you get an elevation certificate, you may be able to show the insurance company that the base elevation has changed, and your premiums may be lowered as a result.

Although FEMA intends to update elevation maps yearly, this does not always occur. However, when it does happen, you are at a distinct advantage when it comes to saving money on insurance premiums. Often, all it takes to reduce or eliminate your insurance premiums is to have FEMA revise the flood plains and the elevation certificates.

Do You Need an Elevation Certificate?

You need an elevation certificate to obtain flood insurance if you have a federally-backed mortgage on the property and if FEMA has determined that your property lies in a Special Flood Hazard Area, like many properties in west Pasco county. You will also be required to obtain an elevation certificate if you are purchasing flood insurance from a private company that is backed by the NFIP. The elevation certificate helps the insurance company determine what the appropriate premiums are. It is also essential that you have your elevation certificate periodically updated, to determine whether or not your property remains in a flood plain, and if the elevation has changed at all. When the elevation changes in your favor, you will save money on your flood insurance.

You can find out if your property is within a Special Flood Hazard Area, as determined by FEMA, by visiting the FEMA website and checking the local maps. It is the lowest floor elevation compared with the Base Flood Elevation (BFE) for your area that determines whether or not your property is at risk of flooding within a one-year period, and this is what the insurance company will use.

Saving Money on Flood Insurance

It is wise to ensure that your elevation certificate is up-to-date and that your insurance company has a current measurement. Flood insurance can be expensive, and if you don’t need it, or don’t need as much coverage, you will save plenty of money on your insurance premiums. Braden Land Surveying provides elevation surveys at an affordable rate. Pasco county flood insurance rate maps were recently updated in 2014, and Pinellas county in 2003. If you have not made any changes to your flood insurance policy since 2014, it is time to re-assess and determine how much money you can save with a new elevation certificate. Call Braden Land Surveying in Pasco county today, and they will provide the details and determine whether or not your elevation has changed in your favor to warrant a new certificate. Visit www.bradensurveying.com for more information.

Distribution Links +

- kake.com

- magic1065.com

- lubbocks969thebull.com

- erienewsnow.com

- fox21delmarva.com

- wboc.com

- wicz.com

- telemundolubbock.com

- tulsacw.com

- weny.com

- 1007thescore.com

- doublet973.com

- 937theeagle.com

- fox34.com

- lubbockcw.com

- mylubbocktv.com

- oldies977lubbock.com

- 1077yesfm.com

- rfdtv.com

- ktvn.com

- wrcbtv.com

- wfmj.com

- htv10.tv

- snntv.com

- central.newschannelnebraska.com

- metro.newschannelnebraska.com

- southeast.newschannelnebraska.com

- midplains.newschannelnebraska.com

- northeast.newschannelnebraska.com

- plattevalley.newschannelnebraska.com

- panhandle.newschannelnebraska.com

- rivercountry.newschannelnebraska.com

- wrde.com

- telemundonuevomexico.com

- cbs19news.com

- wfxg.com

- 1170kfaq.com

- khits.com

- kvoo.com